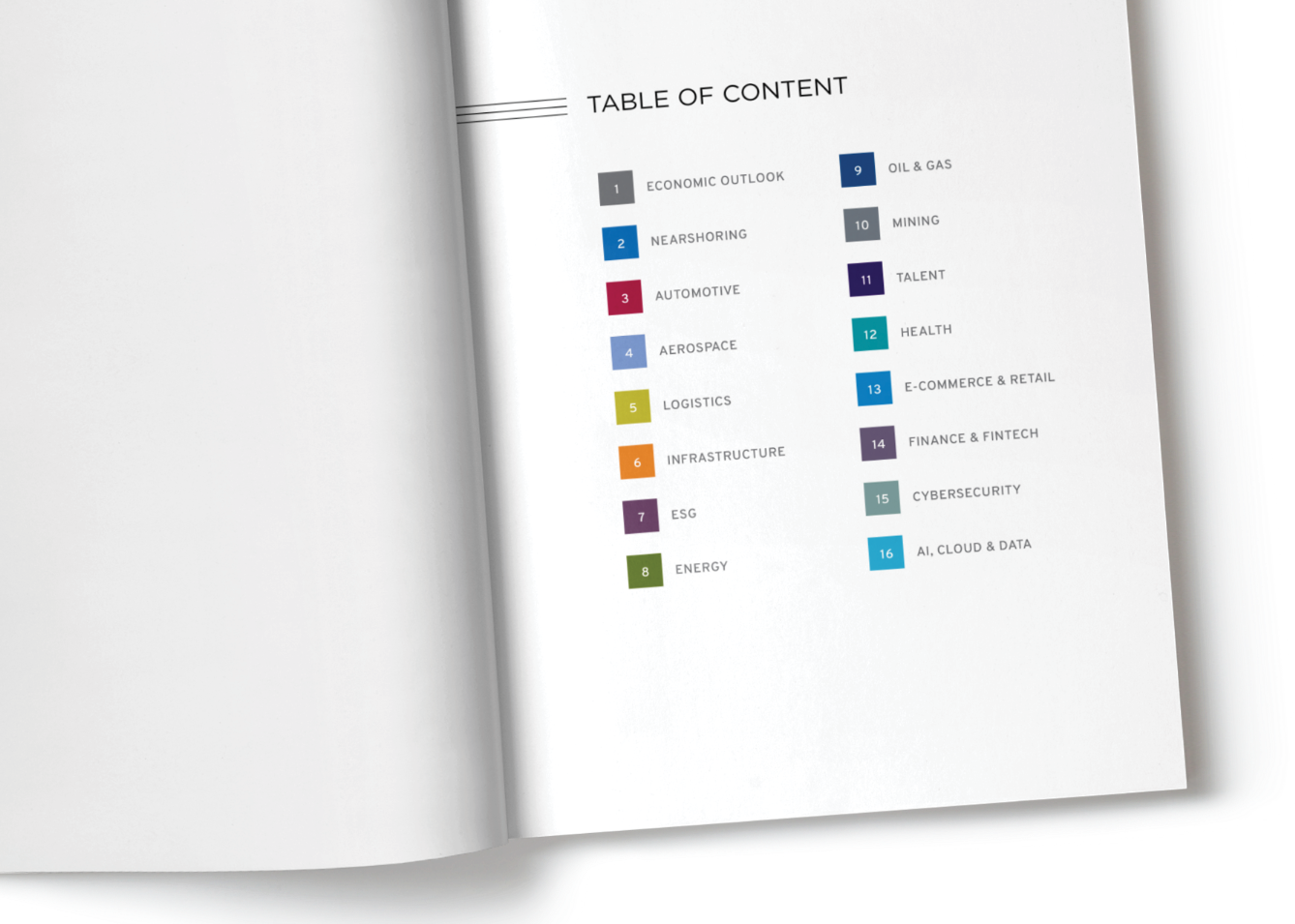

Mexico has left behind an energy monopoly that lasted over 70 years. It did so in less than three. The power auctions and its energy transition plans have placed Mexico among the best markets in the world to invest in renewable energy. In this new and dynamic environment, solar and wind power technologies are storming the industry while both CFE and private players continue revamping old and inefficient fossil fuel plants while adding new ones to run the nation’s baseload capacity on much cleaner and cheaper natural gas.

The launch of the wholesale electricity market in January 2016 was also a breakthrough in the transformation of Mexico’s electricity industry, bringing it closer to modern standards of power generation and trading. Qualified suppliers, generators and marketers are stepping up their game to do business as qualified suppliers after the breakup of the former monopoly held by CFE. With over 180 interviews, Mexico Energy Review 2018 will paint the picture of a radically transformed power market, bringing relevant players, old and new, together in one book.

TRIPLE IMPACT

Mexico Business Review is published as 300+ page, hardcover book, combining first-hand business information with the unmatched experience of high‑quality print media.

The digital, interactive PDF edition presents our carefully curated content in an optimized context while offering the interactivity, ease of use, and easy access of a digital publication.

The first-hand, high-level content of the print and digital editions is interactively connected to expansive complementary editorial, video and audio content resources on Mexico Business News.

ADVERTISING OPPORTUNITIES

- undefined