Get the Insiders’ Perspective

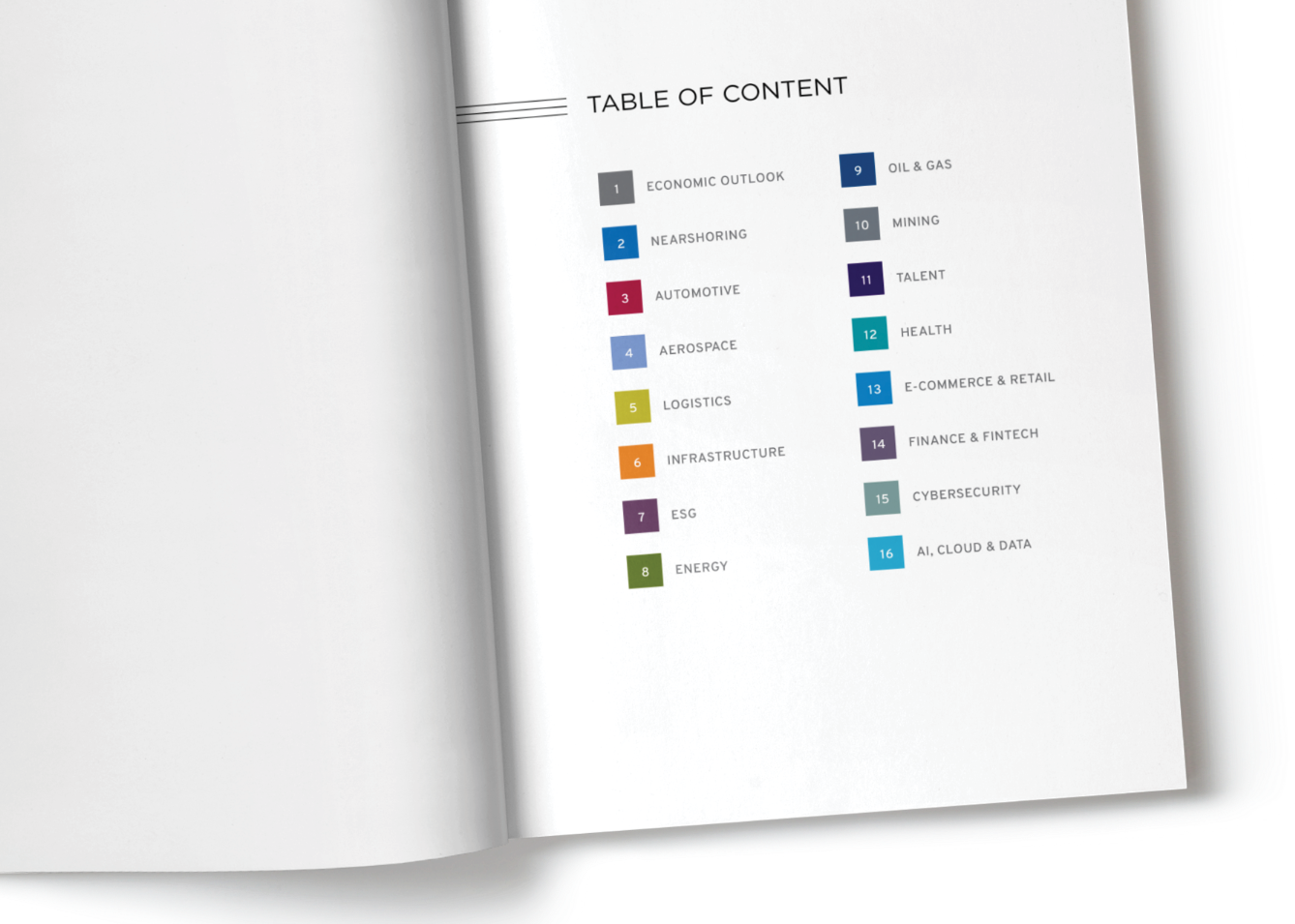

Mexico Infrastructure & Sustainability Review (MISR) is your entrance into the ranks of the elite of Mexico’s infrastructure industry. Take advantage of your chance to meet and network with the leaders who are shaping Mexico’s infrastructure future, including public sector decision makers, institutional investors, issuers of financial vehicles such as CKDs and Fibras, real estate developers, as well as construction and engineering companies. The entire infrastructure value chain is here at a glance.

MISR provides a comprehensive overview of the latest developments, industry trends, business strategies, operational challenges and regulatory framework in the Mexican infrastructure industry. This annual publication is based on more than 180 interviews with the business and political figures who are building the country’s future cities and is destined to serve as an essential decision-making tool at this time of change and opportunity.

Utilizing today’s most impactful business intelligence platforms – print, online and mobile – Mexico Infrastructure & Sustainability Review reaches the sector’s key players, as well as industry executives around the world. Mexico Infrastructure & Sustainability Review serves as a catalyst for growth by accelerating the exchange of essential industry information.

TRIPLE IMPACT

Mexico Business Review is published as 300+ page, hardcover book, combining first-hand business information with the unmatched experience of high‑quality print media.

The digital, interactive PDF edition presents our carefully curated content in an optimized context while offering the interactivity, ease of use, and easy access of a digital publication.

The first-hand, high-level content of the print and digital editions is interactively connected to expansive complementary editorial, video and audio content resources on Mexico Business News.

ADVERTISING OPPORTUNITIES