TRIPLE IMPACT

1PRINT EDITION

Mexico Business Review is published as 300+ page, hardcover book, combining first-hand business information with the unmatched experience of high‑quality print media.

2DIGITAL EDITION

The digital, interactive PDF edition presents our carefully curated content in an optimized context while offering the interactivity, ease of use, and easy access of a digital publication.

3ONLINE EDITION

The first-hand, high-level content of the print and digital editions is interactively connected to expansive complementary editorial, video and audio content resources on Mexico Business News.

ADVERTISING OPPORTUNITIES

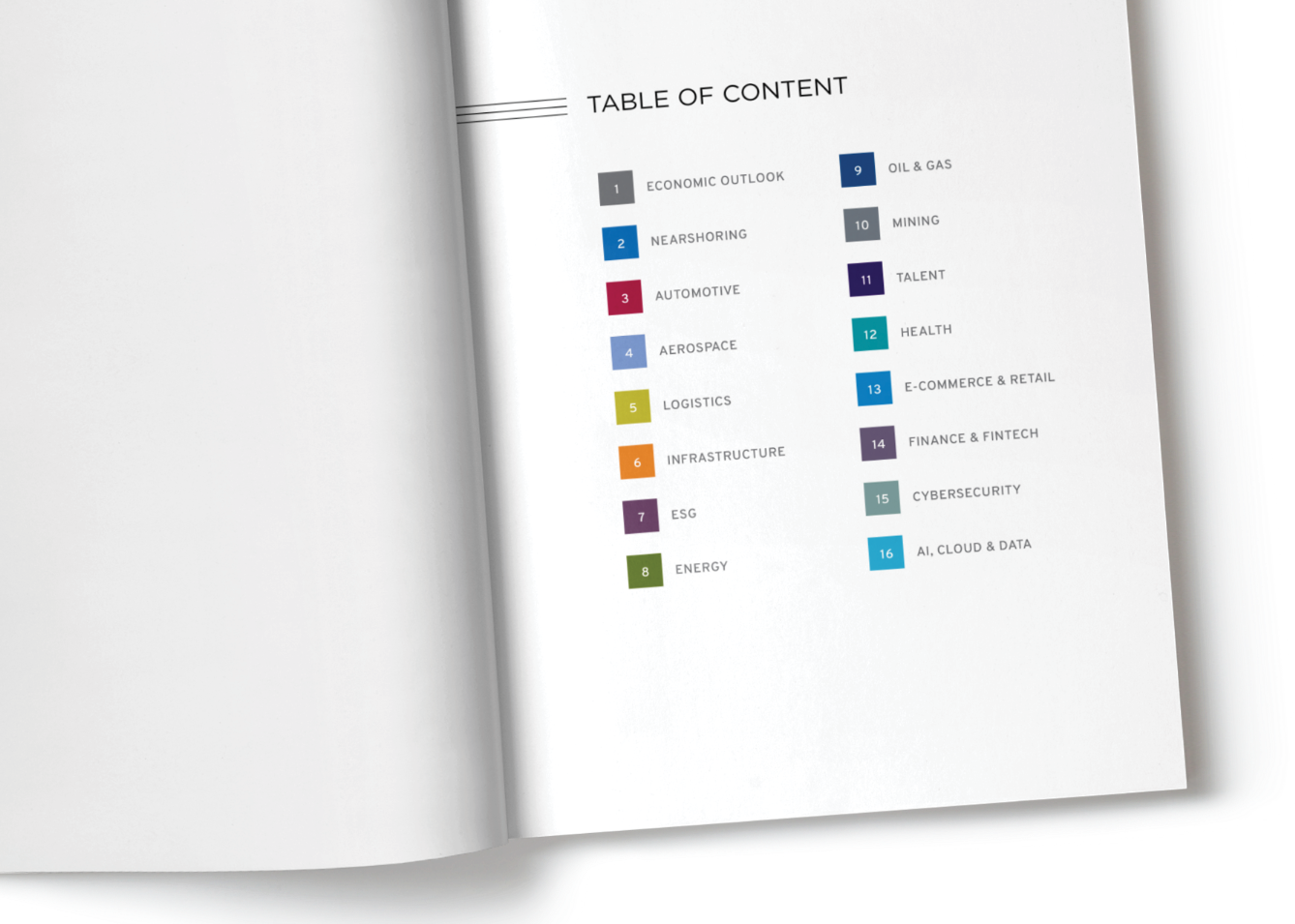

CHAPTER LAYOUT BOOK INTRO

Opening Spread Ad

Book Index Full Page Ad

Index Chapter Full Page Ad

Full Page Ad

Full Page Ad

Editorial Half Page Ad

Full Page Ad